- The ISO 20022 standard itself does not speak to the “speed” of the payment. Not all real-time payment systems are being developed with ISO 20022, and not all ISO 20022 payment systems are real time. For example, SEPA ACH payments utilize ISO 20022 and ISO 20022 does not address the full roles.

- ISO 20022 is an ISO standard for electronic data interchange between financial institutions.It describes a metadata repository containing descriptions of messages and business processes, and a maintenance process for the repository content.The standard covers financial information transferred between financial institutions that includes payment transactions, securities.

- ISO 20022 is a global and open financial messaging standard for financial institutions set by the International Organization for Standardization (ISO), an independent, non-governmental standard-setting body. ISO 20022 is a language based on a business dictionary that unifies many existing, fragmented standards.

- The ISO 20022-to-ACH Mapping Guide & Tool is comprised of eight documents. For each ISO 20022 message, there is a word document that provides background, explanation and examples, and this corresponds to a spreadsheet that provides the detailed data mapping between the ISO 20022 messages and the corresponding ACH transactions.

CHICAGO--(BUSINESS WIRE)--The Federal Reserve today released message specifications for the initial launch of its FedNow Service for instant payments based on the standard set by the International Organization for Standardization, or ISO. The FedNow ISO 20022 specifications define the message flows and formats that the service will leverage when operational in 2023. The release of these specifications is an important step that allows financial institutions and other payments providers to begin preparing systems and developing solutions to support FedNow payments.

What is ISO 20022? ISO 20022 is an ISO standard for electronic data interchange between financial institutions. It describes a metadata repository containing descriptions of messages and business processes, and a maintenance process for the repository content.

“Our work with payments industry stakeholders revealed unanimous support for developing our messaging specs in alignment with the ISO 20022 messaging standard to enable broad interoperability, end-to-end efficiency of payments and future innovation on top of the FedNow platform,” said Nick Stanescu, senior vice president and FedNow business executive. “Our adherence to the ISO 20022 standard means more opportunities for implementation across products and market segments.”

The Federal Reserve also collaborated with The Clearing House to optimize compatibility between the two U.S. instant payment services, which are likely to have common users across the industry. In addition, the individual FedNow message flows and implementation guidelines were validated by experts on the FedNow Community ISO 20022 Working Group and other industry participants in the FedNow Community, including participants from BNY Mellon.

“We were pleased to assist the Federal Reserve in developing messaging specifications that will best serve the banking industry’s needs for instant payments adoption and its long-term evolution,” said Mike Bellacosa, global head of payments and transaction services at BNY Mellon. “We were able to share insights from BNY Mellon’s experience as an instant payments pioneer with the Fed and other working group members, and look forward to continued collaboration with the Federal Reserve as members of its FedNow pilot program.”

Fiserv, an organization that provides financial services and payments technology globally and helps financial institutions connect to payment infrastructures, also took an active role in the FedNow ISO 20022 working group.

“The ISO 20022 message standard is currently used or planned for use by multiple payment systems around the world, an important factor for future interoperability,” said Matthew Wilcox, president, digital payments and data aggregation, Fiserv. “Consistent use of the ISO 20022 standard will enable Fiserv and other global payments stakeholders to leverage our existing investments in payments technology built on the ISO standard, facilitate payments efficiency and speed development of new products.”

The ISO 20022 standard is an internationally accepted messaging format that enables rich data exchanges, efficient end-to-end straight-through payments processing and interoperability with other payment systems. The messages supported in the initial launch of the FedNow Service will include customer credit transfer, request for payment, interbank liquidity transfer and administrative and account reporting messages.

The Federal Reserve is using the MyStandards® platform to provide access to the FedNow ISO 20022 message specifications and accompanying implementation guide. The platform offers standards management tools for financial institutions and other payments service providers that plan to integrate their systems with the FedNow Service. For additional information on accessing the specifications, visit FedNow.org.

About the FedNow Service

The Federal Reserve Banks are developing the FedNow Service to facilitate nationwide reach of instant payment services by financial institutions – regardless of size or geographic location – in near real time, around the clock, every day of the year. Through financial institutions participating in the FedNow Service, businesses and individuals will be able to send and receive instant payments around the clock conveniently, and recipients will have full access to funds within seconds, giving them greater flexibility to manage their money and make time-sensitive payments. Access will be provided through the Federal Reserve’s FedLine® network, which serves more than 10,000 financial institutions directly or through their agents. For more information, visit FedNow.org.

The Financial Services logo, “FedNow,” “FRBservices.org and “FedLine” are service marks of the Federal Reserve Banks. A list of marks related to financial services products that are offered to financial institutions by the Federal Reserve Banks is available at FRBservices.org.

“ISO” is a registered service mark of the International Organization for Standardization.

“MyStandards” is a registered trademark of SWIFT.

CHICAGO--(BUSINESS WIRE)--The Federal Reserve today released message specifications for the initial launch of its FedNow Service for instant payments based on the standard set by the International Organization for Standardization, or ISO. The FedNow ISO 20022 specifications define the message flows and formats that the service will leverage when operational in 2023. The release of these specifications is an important step that allows financial institutions and other payments providers to begin preparing systems and developing solutions to support FedNow payments.

“Our work with payments industry stakeholders revealed unanimous support for developing our messaging specs in alignment with the ISO 20022 messaging standard to enable broad interoperability, end-to-end efficiency of payments and future innovation on top of the FedNow platform,” said Nick Stanescu, senior vice president and FedNow business executive. “Our adherence to the ISO 20022 standard means more opportunities for implementation across products and market segments.”

The Federal Reserve also collaborated with The Clearing House to optimize compatibility between the two U.S. instant payment services, which are likely to have common users across the industry. In addition, the individual FedNow message flows and implementation guidelines were validated by experts on the FedNow Community ISO 20022 Working Group and other industry participants in the FedNow Community, including participants from BNY Mellon.

“We were pleased to assist the Federal Reserve in developing messaging specifications that will best serve the banking industry’s needs for instant payments adoption and its long-term evolution,” said Mike Bellacosa, global head of payments and transaction services at BNY Mellon. “We were able to share insights from BNY Mellon’s experience as an instant payments pioneer with the Fed and other working group members, and look forward to continued collaboration with the Federal Reserve as members of its FedNow pilot program.”

Fiserv, an organization that provides financial services and payments technology globally and helps financial institutions connect to payment infrastructures, also took an active role in the FedNow ISO 20022 working group.

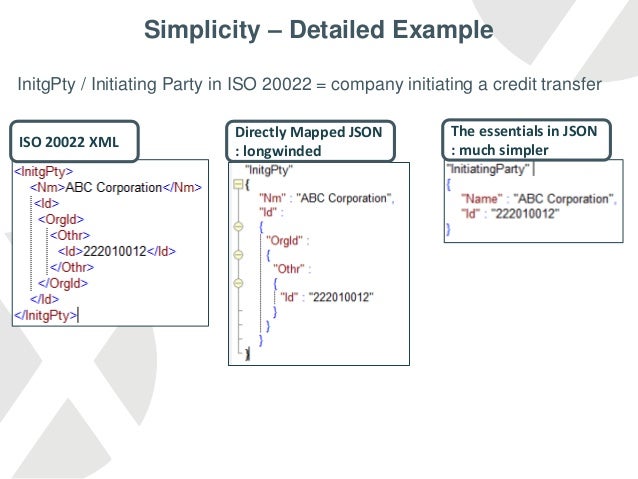

Iso 20022 Example Message

“The ISO 20022 message standard is currently used or planned for use by multiple payment systems around the world, an important factor for future interoperability,” said Matthew Wilcox, president, digital payments and data aggregation, Fiserv. “Consistent use of the ISO 20022 standard will enable Fiserv and other global payments stakeholders to leverage our existing investments in payments technology built on the ISO standard, facilitate payments efficiency and speed development of new products.”

The ISO 20022 standard is an internationally accepted messaging format that enables rich data exchanges, efficient end-to-end straight-through payments processing and interoperability with other payment systems. The messages supported in the initial launch of the FedNow Service will include customer credit transfer, request for payment, interbank liquidity transfer and administrative and account reporting messages.

Iso 20022 Payment Example

The Federal Reserve is using the MyStandards® platform to provide access to the FedNow ISO 20022 message specifications and accompanying implementation guide. The platform offers standards management tools for financial institutions and other payments service providers that plan to integrate their systems with the FedNow Service. For additional information on accessing the specifications, visit FedNow.org.

Iso 20022 Format Example

About the FedNow Service

The Federal Reserve Banks are developing the FedNow Service to facilitate nationwide reach of instant payment services by financial institutions – regardless of size or geographic location – in near real time, around the clock, every day of the year. Through financial institutions participating in the FedNow Service, businesses and individuals will be able to send and receive instant payments around the clock conveniently, and recipients will have full access to funds within seconds, giving them greater flexibility to manage their money and make time-sensitive payments. Access will be provided through the Federal Reserve’s FedLine® network, which serves more than 10,000 financial institutions directly or through their agents. For more information, visit FedNow.org.

The Financial Services logo, “FedNow,” “FRBservices.org and “FedLine” are service marks of the Federal Reserve Banks. A list of marks related to financial services products that are offered to financial institutions by the Federal Reserve Banks is available at FRBservices.org.

“ISO” is a registered service mark of the International Organization for Standardization.

“MyStandards” is a registered trademark of SWIFT.